irs child tax credit dates

Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. When you file your 2021 tax return you can claim the other half of the total.

Where Is My September Child Tax Credit 10tv Com

Los Angeles Times - Summer Lin 1h.

. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per month. The application period will close on July 31 2022 and payments. They could also get up to 250 per qualifying child between 6 and 17 years or a total of 3000.

That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. Reaction on the Hill. The IRS has created a special Advance Child Tax Credit 2021 page with the most up-to-date information about the credit and the advance payments.

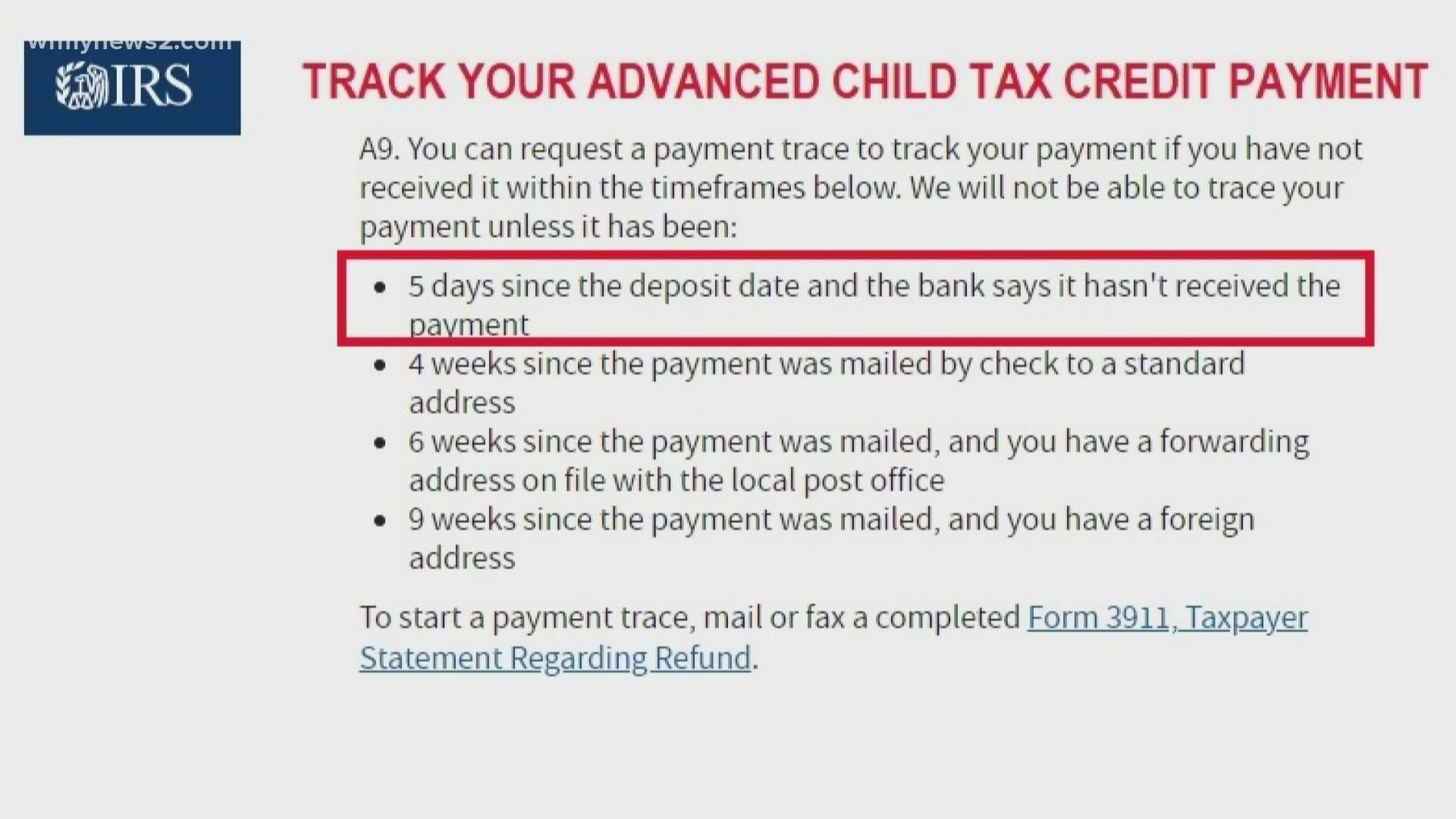

The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. CPA Larry Pon provides guidance if you were one of the people who did not receive your child tax credit and should have. To apply applicants should visit portalctgovDRS and click the icon that says 2022 CT Child Tax Rebate.

As United States tax codes allows for. 1 day agoIRS mishandles child tax credit payments. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

To be a qualifying child for. Fifty-six people have been arrested in connection with the theft of nearly 5 million from hundreds of California residents in a widespread stolen check. The IRS will send out the next round of child tax credit payments on October.

The IRS bases your childs eligibility on their age on Dec. To get money to families sooner the IRS will send families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the. For both age groups the rest of the.

The payments stem from the Democrats 19 trillion American Rescue Plan which beefed up the existing child tax credit giving families up to 3600 for each child under 6 and. 12 hours agoIn simple terms a K-1 form is a tax form provided by the Internal Revenue Services IRS which is issued annually to business entities.

Irs Opens Child Tax Credit Portal How To Check If You Re Getting 300 Monthly Payments Syracuse Com

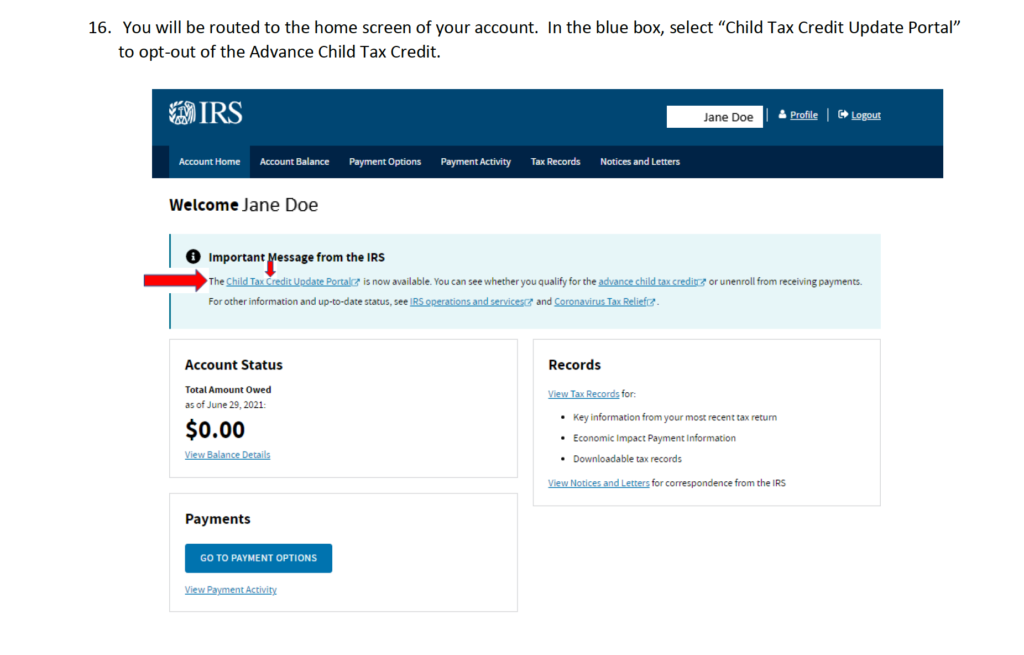

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

How To Opt Out Of The Advance Child Tax Credit Payments

Child Tax Credit Advance Monthly Payments Explained Donovan

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Child Tax Credit Payments May Be Smaller For Some Going Forward 10tv Com

2021 Advanced Child Tax Credit What It Means For Your Family

Making Sense Of The Advanced Child Tax Credit Payments The Pastor S Wallet

Advance Child Tax Credit Payments Youtube

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2021 Changes Grass Roots Taxes

Child Tax Credit Update Irs Sending Letters To Families Who May Get Monthly Payments Kiplinger

Child Tax Credit Irs Unveils Address Change Feature For September Payment

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments